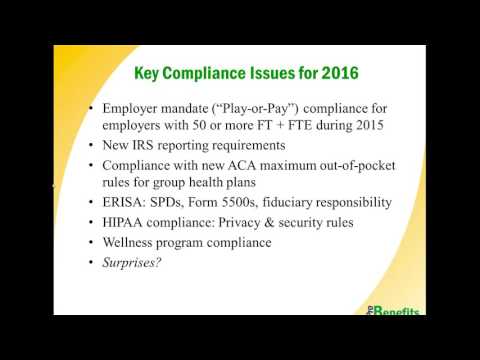

Good morning everyone and thank you for joining us. My name is Jason Cargill, and I'm one of the two benefits attorneys at Probe Benefits. I'm here with my colleague, Chris McCauley, for what is our final client webinar of 2015. We've had a busy year full of webinars, starting from January. Our webinars cover various compliance and benefits topics, including our standard monthly webinars and a new format we introduced this year - three sessions of a mini webinar that lasted 15 minutes each, focusing on a single topic. We will continue this format into 2016 and will be releasing our list of 2016 webinars soon. If you have any specific topics that you would like to hear more about, or any other input that may be helpful for the upcoming year, we would be happy to hear it. Thanks again for joining us today. During 2015, Chris and I enjoyed doing the webinars and learning a lot from working with you all and hearing the questions that employers have on various topics. Webinars like this are valuable ways for us to share our expertise with employers and advisors. We are excited to continue doing it. Our topic today is the end-of-year compliance review and a 2016 compliance checklist. Our goal for today is to simplify things for you. There are many things happening in the benefits field right now and a lot of items on the to-do list for benefits and HR departments. Our goal is to simplify and highlight the hot topics and key issues that you need to address as we move forward. You should have received a copy of our 2016 compliance checklist along with the webinar invitation. If you don't have access to it, I will be showing it on the screen shortly, and we can...

Award-winning PDF software

5500 extension due date 2024 Form: What You Should Know

Sep 15, 2024 — IRS The normal due date is the date the Form 5500, Form 5500-SF, Form 5500-EZ, and/or Form 8955-SSA would otherwise be due, without extension. Why Is The Form 5500 Due By April 1, 2019? The IRS has extended the due date on the April Filing Deadline for the year-end Form 5500 as follows: April 15, 2024 – August 2, 2019, April 14, 2024 – April 1, 2021, April 14, 2024 – January 31, 2022, Notice Regarding Form 5500-FA 2018 The IRS today announced that filing the form by April 1, 2019, and requesting an extension for calendar years 2024 through 2022, will meet the 2024 filing deadline for the Employer Health Benefits Survey. Individuals eligible to file under the IRS's alternative methods for filing are also eligible to file through the Internet. See the 2024 Annual Report in Part 2 for information on the Alternative Filing methods available. Form 5500-FA 2024 is not due until February 18, 2019. For further assistance with the Annual Report, please visit our help section or contact the toll-free phone number listed below. Callers may enter a general question, “Will the IRS file the Form 5500 before the deadline?” in the appropriate field to ensure that IRS receives and responds to your question. To be eligible for a credit on Form 709, individuals must have filed an annual income tax return for the previous tax year and for the current tax return. To get tax help and to learn more about the alternative filing methods in Part 2, go to IRS.gov/AlternativeFiling IRS to Add One-Time Form 8955 for Self-Employed Individuals with Qualified Plans — IRS.gov/Form8955 The IRS today announced an addendum to the Form 8955-SSA, in which it is expanding the options available to self-employed individuals qualifying for a modified election. Specifically, Form 8955-SSA will now allow an individual to elect an exception to the self-employment tax imposed under section 6038C, which requires a single or joint taxable income of less than 600,000 per year. For more details, see IR-2 and .

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5500 - Schedule H, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5500 - Schedule H online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5500 - Schedule H by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5500 - Schedule H from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5500 Extension Due Date 2024